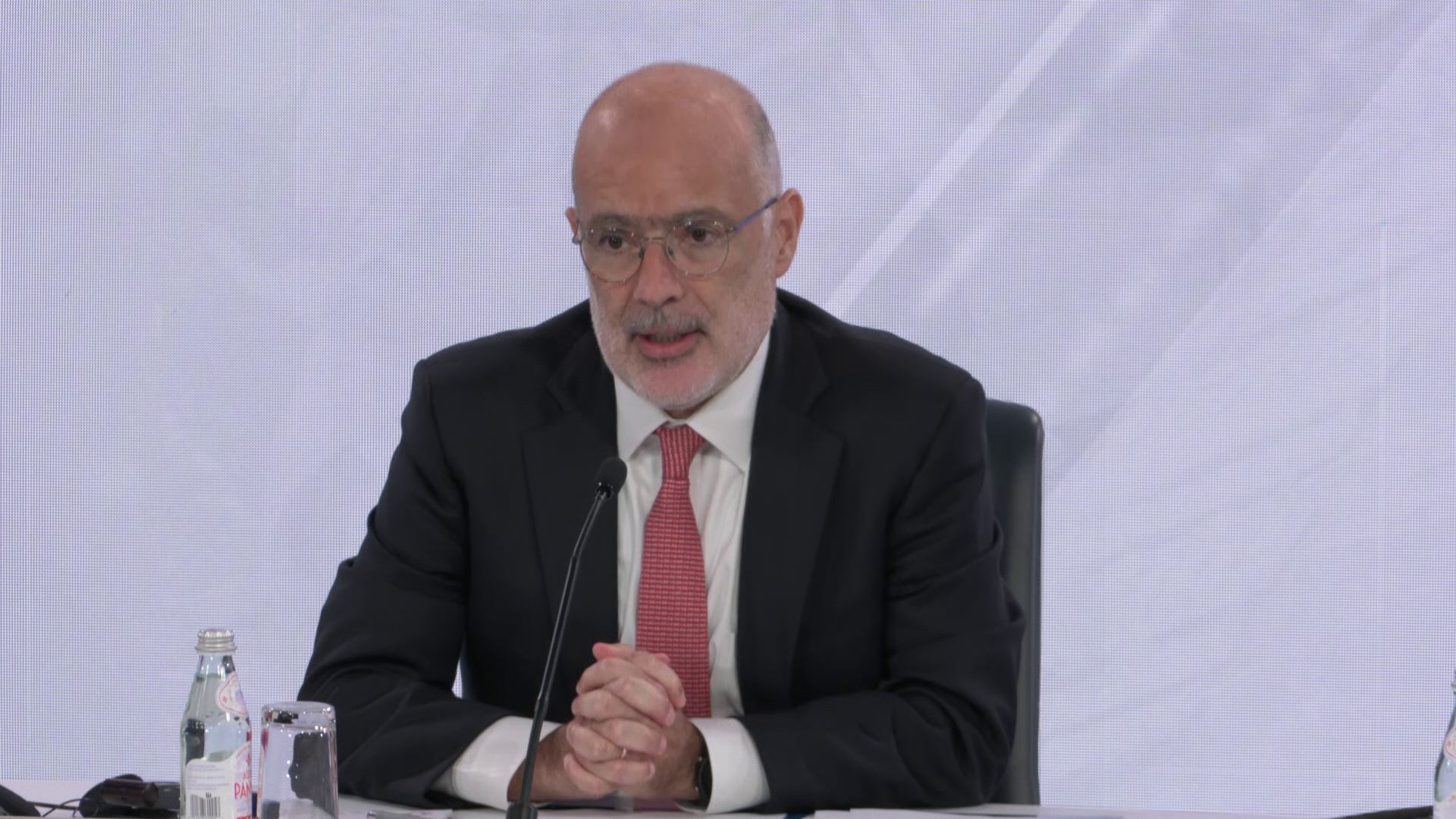

Despite volatile global conditions, Latin America and the Caribbean have managed to stay on a steady growth path. Speaking at the International Monetary Fund (IMF) 2025 Annual Meeting, Rodrigo Valdés, IMF’s Director of the Western Hemisphere Department, outlined a picture of resilience supported by easing external pressures but tempered by fiscal and structural challenges that could weigh on the outlook.

“Growth in Latin America and the Caribbean has experienced no major disruptions in the first half of this year, and it's projected to remain steady at 2.4% in this year, 2025, and moderate very slightly next year. Although risks are clearly to the downside. Despite the uncertainty, global conditions have been broadly supportive for the region. Commodity prices, for example, have stabilized after a brief period of volatility, in the first part of the year. Financial conditions have eased, amid declining sovereign spreads and a weak, U.S. dollar in comparison to last year. Importantly, regional exports have kept pace with global trends of [inaudible] firm trade. Domestically, labor markets remain robust, generally supporting private consumption in most economies. Also, low exposure of many economies to the U.S., lower tariffs for the region in comparison to other regions, also have provided some buffers,” explained Valdés.

Beneath that resilience, policy settings remain under strain, with insufficient fiscal effort blunting the impact of monetary policy. Fiscal positions in many countries have strengthened, and many governments have laid out credible fiscal plans, but implementation has lagged, leaving primary balances weaker than anticipated and debt ratios on the rise. This widening gap between plans and execution is sharpening the need for timely fiscal consolidation to contain risk premiums and preserve room for maneuver.

“Inflation remains above target in some countries. [Inaudible] relatively more balanced risks in comparison to output. Robust labor markets and fiscal concerns are slowing disinflation, but at the same time, the recent exchange rate appreciation, is helping in some cases. Central banks in the region have responded appropriately. They remain data-driven, and inflation expectations are stable, but also remain a bit above targets in some cases. Continued caution is warranted in this case, especially in countries where economic slack is not evident and inflation remains above target. Looking ahead, the region's potential growth remains stuck in its low level that we have seen historically and clearly-lagging emerging market peers around the world. This reflects slowing labor force expansion, low capital accumulation, and especially stagnant productivity,” said Valdés.

The latest Regional Economic Outlook digs deeper into the fiscal and structural constraints behind these persistent pressures. One study suggests that advancing fiscal consolidation and improving fiscal frameworks could reinforce policy credibility and accelerate convergence toward inflation targets. Another study finds that better resource allocation and easing regulatory frictions, financing constraints, and weak competition could spur growth. The Fund’s analysis underscores both the scale of the challenges and the importance of continued engagement and support to help countries strengthen their policy responses.

“The fund remains closely engaged with the region through policy advice, capacity development and financial support. In terms of program engagement, since April – the last time we saw each other – I can inform that Barbados completed its arrangement under the Extended Fund Facility and the Resilience and Sustainability Facility, and a new flexible credit line (FCL) has been launched with Costa Rica, while Colombia canceled its FCL. To sum up, the global landscape is shifting, but this is not reason for inaction. As the saying goes, countries may not control the winds – ships is actually the saying – but they can adjust their sails. Reinforcing policy frameworks, rebuilding fiscal buffers, and fostering growth opportunities are the sails that need to be adjusted,” concluded Valdés.