Economic life after lockdown

What will the re-start look like in the short, medium and long-term?

The acute phase of the coronavirus crisis may be close to over. National governments may be keen to downplay it to maintain public compliance but during May almost all of the statutory lockdowns currently in place globally are expected to be relaxed. Diabolical flash PMI data for April may therefore represent the trough in economic sentiment for the very short-term. Yet at least until the end of the 2020, national economies will have to contend with the prospect of social distancing measures and the risk of a second wave of infections, a dampener for spending and investment. For the longer-term, we expect an acceleration of the trend to conduct business digitally as it is now proven to be effective while cheaper, enables social distancing and has a smaller environmental footprint. We remain neutral on global equity markets as valuations have recovered from the distressed levels seen during March.

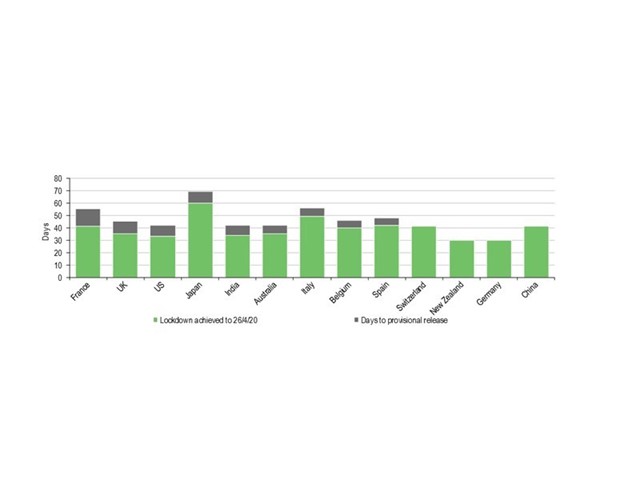

Exhibit 1: Lockdown periods nearly complete across developed markets

In only a few weeks, the strict lockdowns which have been imposed on a significant proportion of the global population will be eased at least in part, allowing schools and businesses to reopen. Strict non-pharmaceutical interventions have been effective in bringing R0 below 1 and infection rates are for most nations on declining trends. Yet the economic cost has been enormous. Over 25m jobs have been lost in the US alone and unemployment is forecast to double in the UK to 10% by the end of the year.

Economic considerations will drive the lockdown release schedule

It is not feasible from a social, political or economic perspective to allow strict lockdowns to continue for significantly longer periods in our view. Strict lockdowns impose such severe economic damage to both private sector and government balance sheets that structural damage to future GDP becomes an inevitability, even before considering the interruption to education and training programmes.

The recent PMI data for Europe and the US should be instructive for policymakers as record-low sentiment across the region highlights the damage being done to the global economy during April. Furthermore, projections from the UK’s Office of Budget Responsibility indicate that UK GDP may decline by 35% during Q220. We would not disagree with this assessment but would also highlight the same projections suggest that GDP will return to its previous trajectory by Q121. We find this somewhat optimistic in a world without a COVID-19 vaccine and, as a result, with social distancing still in place.

Nevertheless, in coming weeks investors are likely to welcome the flow of company news releases announcing the restart of operations as supply chains come back to life. Due to the time-lags involved there will also be insufficient infection rate data in the very short-term to signal whether less restrictive social distancing measures will result in the feared second surge in hospital admissions.

We suspect that in the relatively controlled environment of workplace settings such as construction sites, offices and factories, strict monitoring of facilities with improved hygiene and health tracking may be effective in reducing workplace transmissions while keeping productivity largely intact. In profitability terms these sectors will therefore be the first to recover, provided there is sufficient demand.

Post-lockdown social distancing an enduring threat to travel and leisure sector

In contrast, social and leisure activities and transportation hubs are where the greatest risks to an extended period of sub-par profitability lie in our view. These sectors are likely to suffer the longest coronavirus restrictions. Large gatherings of people are unlikely to be permitted until there is confidence that sufficiently effective tracking technology is available which can mitigate a potentially major super-spreader event, but without shuttering the economy. The inherent biological risks in large social gatherings will unfortunately have significant implications for live sporting events, the gambling sector and other leisure activities.

The resumption of international travel carries further political question marks, given the lack of a globally coordinated response to COVID-19. Politically, it will be difficult to sanction the resumption of flights to foreign destinations unless there is confidence that the corresponding nation has the epidemic properly controlled and sufficient monitoring is in place to ensure the health and tracking of passengers returning from trips overseas. In turn from a demand perspective, passengers are unlikely to wish to travel until there is confidence self-isolation will not be necessary upon their return home, as currently mooted in the UK in recent days.

The considerations for business owners are not just biological as there are likely to be serious profitability issues in the service sector for as long as social distancing remains in place. Most obviously many bars, restaurants and other entertainment venues will be unprofitable if forced to comply with social distancing measures such as closed bar areas and enforced table spacing. In the circumstances, many hospitality venues may choose to remain closed. Airline profitability would be significantly impacted by current suggestions to vacate the middle seat while lost revenues from ticket sales at sporting events may prejudice the sporting calendar even after fixtures are allowed.

Rolling lockdown release risks stymieing consumer demand

There is a meaningful risk that the forecast and significant rise in unemployment in many nations will add to the financial pressure on service sectors struggling to regain profitability while implementing social distancing. This interim socially distanced period between lockdown and vaccine will present a number of challenges in these sectors for which there are few easy answers.

The challenge for policy will therefore be how to implement a progressive rollback of lockdowns while maintaining a sufficient level of consumer demand to incentivise business to keep people on the payroll and continue investing wherever possible. We note the UK’s furlough schemes is unlikely to be extended indefinitely as it costs the government around 2% of GDP per month.

While a rolling restart might be optimal from a virus perspective, policies which mitigate the impact of rapidly rising unemployment in this scenario may be necessary, as the younger working-age segment of the population makes the lifestyle and financial sacrifices necessary to protect the health of older members of the public.

Fiscal support has been forthcoming but at what cost?

We believe at present investors are quite correct in assuming that extensive fiscal support will be made available to prevent the healthcare crisis turning into an extended period of sub-par economic activity. Fortunately for the global economy, the exogenous nature of this shock has precluded any talk of moral hazard which has in turn allowed a very rapid use of government balance sheets to address some of the distributional consequences of measures to control the spread of coronavirus. Furthermore, the re-start of quantitative easing by central banks means that increased issuance of government bonds is likely to be readily absorbed at current market yields.

The longer-term impact on government balance sheets should not however be underestimated. Our initial view that lockdowns were likely to be imposed for weeks rather than months was largely based on the unsustainability of the extraordinary costs to national governments of shuttering the economy and supporting furloughed workers.

For example, the UK’s OBR has projected that UK debt to GDP will rise to 95% by 2021, 17% above its pre-COVID-19 reference scenario. This also assumes the rapid return to trend levels of GDP growth by the end of 2020. The reduction in interest rate expectations and the lingering concerns in terms of the sustainability of the debt burdens of developed nations has lent increasing support to the gold price during 2020 to date.

A transfer union? COVID-19 re-opens EU’s north/south divide

Furthermore, it is not the case that all developed nations are equal in the face of COVID-19. Existing fragilities in terms of debt sustainability will be emphasised in nations with higher debt/GDP burdens such those in Southern Europe. Furthermore, the higher share of tourism and leisure in GDP risks a very difficult summer for these regions as those activities are likely to be among the last to recover.

For these reasons, the EU and its member states will have to move swiftly to implement fiscal policies which can accommodate the very large deviations from trend GDP now expected in southern Europe. During this healthcare crisis, the spread between Italian government 10-year bonds and German bunds has risen from 1.5% to close to 2.5%, highlighting the risk of a failure to reach an agreement to once again support the economies at the periphery of the eurozone.

The beauty of Mario Draghi’s original “whatever it takes” speech in 2012 was that in the end only the prospect rather than the actuality of “Outright Monetary Transactions” were needed to restore confidence. Following coronavirus, specific and actual policy support is likely to be needed to ensure all nations within Europe can continue to fund themselves through a period of economic growth as weak as 2008. An initial EUR 540bn healthcare-related support package, finally agreed last week, is unlikely to be sufficient to compensate for the substantial shortfall in GDP expected in 2020.

EU commission talk of a trillion dollar recovery fund remains notional for at least for as long as Northern nations resist moves towards common debt instruments, such as corona-bonds. We believe investors should carefully monitor policy in Europe as there remains a risk that long-standing political impediments to wealth transfer obstruct the necessary financial flows required to deal with the fallout from COVID-19.

According to reports, there remains the long-standing division between France, Spain and Italy which favour grants to tackle the damage from COVID-19 and Northern European nations such as Germany where Angela Merkel has insisted any aid must ultimately be repaid. We expect there to be further wrangling over the matter at least until mid-May when the EU is expected return with further proposal, but would caution that earlier calls for mutual debt instruments appear to have been firmly ruled out.

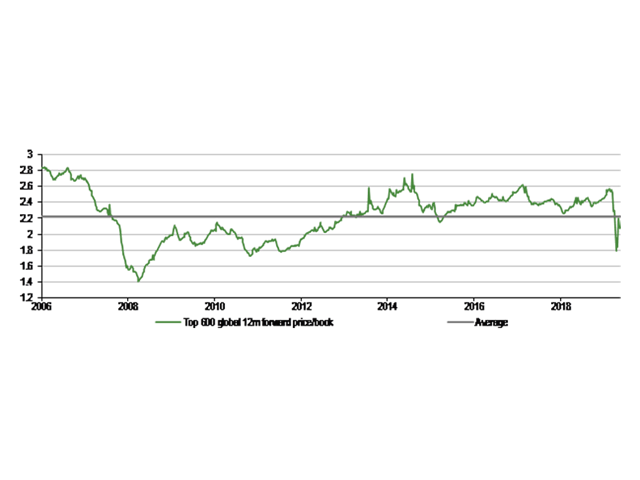

Global equity valuations have rebounded following a 50% retracement

In terms of equity valuations, markets have on a global basis re-traced 50% of the initial losses following the introduction of substantial support programs from central banks. On a price/book basis, the top 600 global companies worldwide no longer appear inexpensive following the market recovery. Similar rebounds in pricing to equity markets are also visible in credit markets as spreads have tightened notably since the peak of the sell-off during March.

Exhibit 2: Price/book of largest global companies now close to long term average

Excess returns from broad market exposure therefore appear to be in the rear-view mirror on a global basis. European equities do appear relatively cheaper even after the recent recovery, although investors there have to contend with both Brexit and potential eurozone stability remaining as outstanding question marks.

A sector focus is now appropriate rather than blanket market exposure

Following the recent recovery, we believe investors should take the opportunity to carefully review portfolios to ensure that equity risk is focused on the right companies and sectors. The release from lockdown in Europe and the US is a welcome development but also appears to be a more drawn-out and progressive affair than that seen in China earlier in the year. Certain sectors are likely to see significant constraints on activity for a number of months ahead. Notably, “stay at home” orders for returning overseas travellers would be likely to have a strong negative impact on both business and leisure demand in the travel and hospitality sectors during the summer season.

We believe the behavioural changes in terms of social distancing are likely to persist where they have simply accelerated long-term trends in terms of the environment or digitalisation of the economy. Many businesses have now demonstrated that they can function with a significant degree of home working, allowing further compression of future office requirements. This also has implications for ancillary activities such as retail in business districts, as employees benefit from flexible hours and retail shifts further online.

Similarly, we suspect many corporates will take the opportunity to insist on travel only when it is absolutely necessary in future, initially to reduce the risk of COVID-19 infection but later to reduce corporate expenses as online business becomes an increasingly acceptable way of working. Progress in these areas implies a bright outlook for the digital alternatives to face-to-face communication. We expect a resurgence in growth in the full suite of digital remote working tools, from secure cloud-based corporate storage and application delivery to telepresence solutions. Videoconferencing has traditionally been difficult to monetise and software as a result dated and clunky but further quality improvements should be expected to narrow the perceived quality differential between an actual and virtual meeting.

From an environmental perspective, less frequent transportation usage and a smaller office footprint has obvious environmental benefits both in terms of urban air pollution and global energy usage and the coronavirus episode will have highlighted wasteful and unproductive carbon emissions which can now be addressed.

Despite the upcoming release of lockdowns, as market valuations have already rebounded significantly from the lows of March we retain a neutral weighting to global equities. Should social distancing, contract tracing and testing measures sufficiently slow the spread of coronavirus post-lockdown, we expect economic activity will gradually return to normal over the next 12m, even if punctuated with further lockdowns in specific regions or cities, allowing risk premia in equity markets to contract further.

On the other hand, relatively high degree of compliance with lockdown instructions has left the population with very little immunity and a second wave of infections cannot at this point be excluded by any means.

Given the rebound in market valuations, we believe investors should be increasingly specific in terms of sectors and specific companies rather than pursuing blanket market exposure. There are some sectors such as healthcare and software which may pass through this episode virtually unscathed, leaving others dealing with the aftermath for up to a year, or least until a vaccine becomes available.

Ultra-low bond yields and the death of inflation – risks over the horizon?

At current ultra-low yields we view government bond markets with some caution given the size of the fiscal response required now and in coming years to offset the damage to the global economy. It has become something of a mantra in certain circles that public debt levels do not matter (although those resident in Greece may beg to differ) but long-term interest rate markets have progressively become dictated by central bank policy over the past decade and especially so over the last 3 months. Those forecasting inflation have been proved “wrong” if they targeted CPI or long term bond yields – but on a number of occasions asset prices have in our view been pushed to higher valuation levels than warranted by other fundamentals, and as intended by monetary policymakers.

We do not expect central banks to step back from their expanded role for the foreseeable future which is intellectually one of the least comforting but practically one of the strongest reasons to maintain risk exposures in portfolios. Nevertheless, the strong performance of gold this year is a warning shot to those who consider that large fiscal deficits combined with monetary policy in today’s form has no limits.