Central Asia is gaining more and more importance for the automotive industry – both as a sales market and production site. Chinese brands are making their way into the local market. The expansion of regional production facilities is picking up speed, and with it the region’s importance as a hub between East and West.

Made up of Kazakhstan, Uzbekistan, Kyrgyzstan, Tajikistan, and Turkmenistan, Central Asia is increasingly coming into the focus of the international automotive industry. Home to over 80 million people, the region is one of the world’s emerging markets. Kazakhstan is not only the largest automotive market in the region –with around 200,000 new registrations in 2023– it is also a growing centre of car production. The Allur Group plays a particularly important role here. Its plant in Kostanai assembles vehicles for brands such as Chevrolet, JAC, Chery, Kia, and Hyundai. Local production covers around 70 per cent of the domestic market. The industry is supported by the duty-free import of parts, tax concessions, and strategic partnerships with Chinese original equipment manufacturers (OEMs), among others.

At 36 million inhabitants, Uzbekistan is not only the most populous country in Central Asia, but has also traditionally been the region’s industrial heartland. The state-owned company UzAuto Motors (formerly GM Uzbekistan) dominates the passenger car market, holding a market share over 90 per cent. It manufactures Chevrolet models such as the Cobalt, Nexia, and Tracker, which are largely based on former General Motors platforms.

Production takes place in several factories, primarily in Asaka. Some 280,000 vehicles are produced each year, a share of which are exported to countries such as Russia, Azerbaijan, and Georgia. To weather the growing competition from Chinese manufacturers, Uzbekistan launched a joint venture with the Chinese company BYD in 2023. The local government has also announced plans to promote electric vehicle production in the Ferghana region, where a factory is set to be built with Chinese support at a cost of around 1.5 billion US dollars.

The geopolitical significance is growing

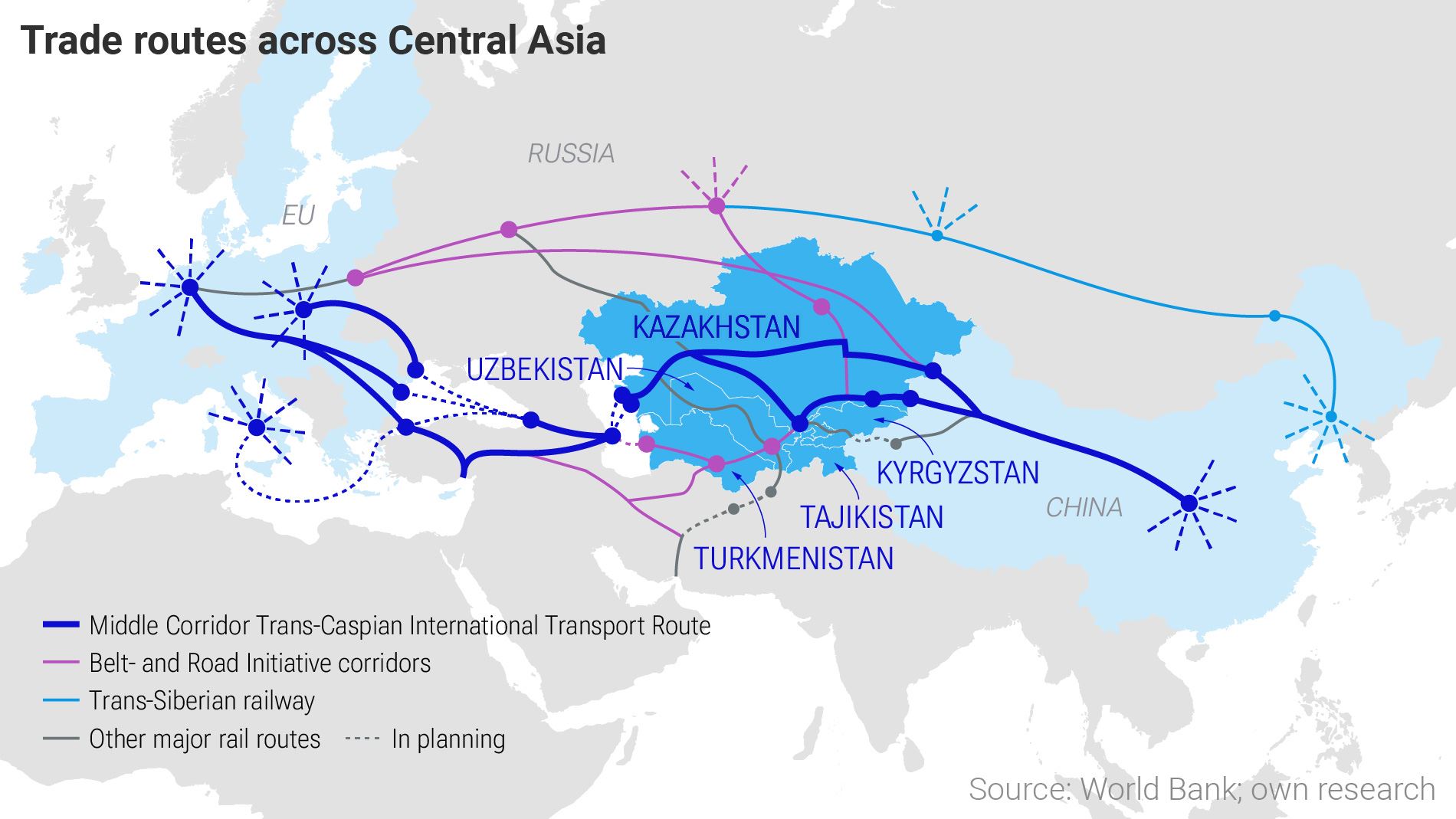

“The expansion of the Central Transport Corridor and the planned main railway line between Uzbekistan, Kyrgyzstan, and the Chinese Xinjiang will facilitate the import of Chinese vehicles and promote export products ‘Made in Central Asia’ to China and Europe,” says Vladimir Nikitenko, Regional Director for Central Asia on the Committee on Eastern Affairs of the German Economy.

The region is not only a transit corridor for goods, but is also increasingly becoming a sales market for vehicles. China in particular is investing heavily there, especially in the automotive sector – and with a long-term interest. “The sanctions against Russia and the global changes in supply chains have accelerated the trend towards Chinese suppliers. Many Central Asian retailers and consumers no longer look at Chinese manufacturers as an alternative option, but as long-term strategic partners. Additionally, re-export routes via Kazakhstan and Uzbekistan have established the region as a hub for parallel imports,” says Nodir Ayupov, Schneider Group’s Central Asia expert. In terms of foreign and economic policy, the countries of Central Asia are trying to maintain open relations with all parties. “They maintain diplomatic and economic relations with major players such as Russia, China, the US and the EU, while trying to balance the significant influence of their neighbouring states,” says Nikitenko.

Continue reading on Gateway to Automotive.