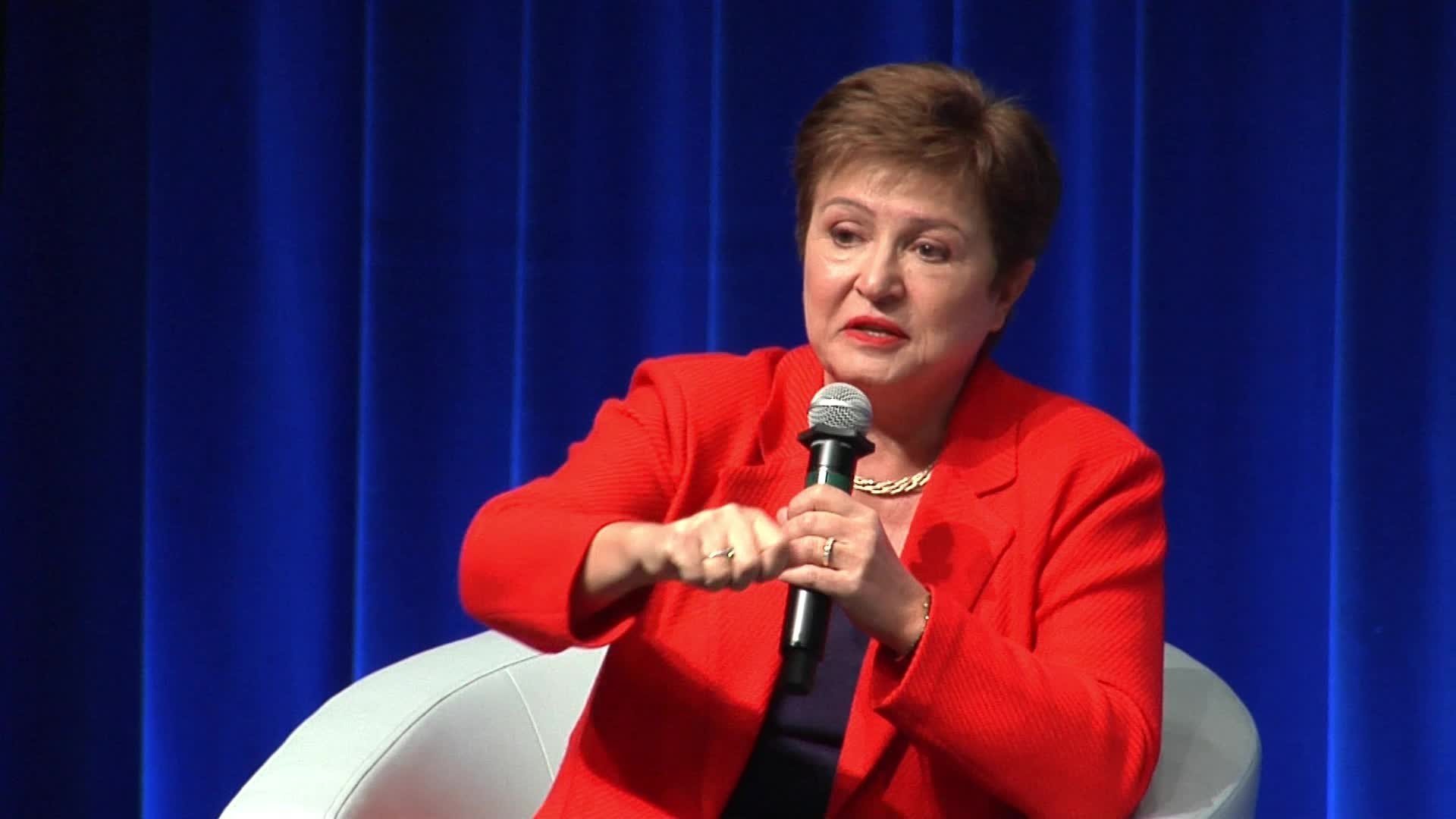

With investors globally increasingly chasing riskier yields in lending, IMF Managing Director Kristalina Georgieva urged low income countries to take a hard look at how they are approaching their debt strategy.

Speaking at a joint event hosted by the World Bank looking at global debt on Monday in Washington, DC (Feb 10) she urged developing countries to focus on using that money prudently with an eye on the long term.

“In this more interdependent and more shock prone world, it is in everybody's interest to improve transparency and improve reporting,” she said referencing the outbreak of coronavirus in China and its spread globally as an example of unforeseen risk.

She said that with long term interest rates so low in Europe and the US, investors were looking for places where they can expect higher returns. But she warned that just because there were anxious lenders, low income countries should not load up on debt.

“We need to be mindful that in this world of pressure for debt restructuring, the very best we can do is to emphasize much more strongly prevention, because prevention is better than cure. Don't get in this place to begin with. And for many countries, I would really argue that when they are in trouble around debt, they ought to get serious about the macro framework that may have contributed to be in this place to begin with. And I think anyway, you cut it there is no substitute for responsible policies,” said Georgieva.

She said that ‘cheap money’ should not be seen as a license to continue ineffective policies, but can be a lifeline to start investing in new positive steps.

“Let's remember why. Why? I mean, why I worry so much about that in low income countries. Because what it means is that if it is not properly managed, interest rates - often high - takes away precious resources from education and call and help in infrastructure investments. Takes it away from people who are most in need of quality of investments.”