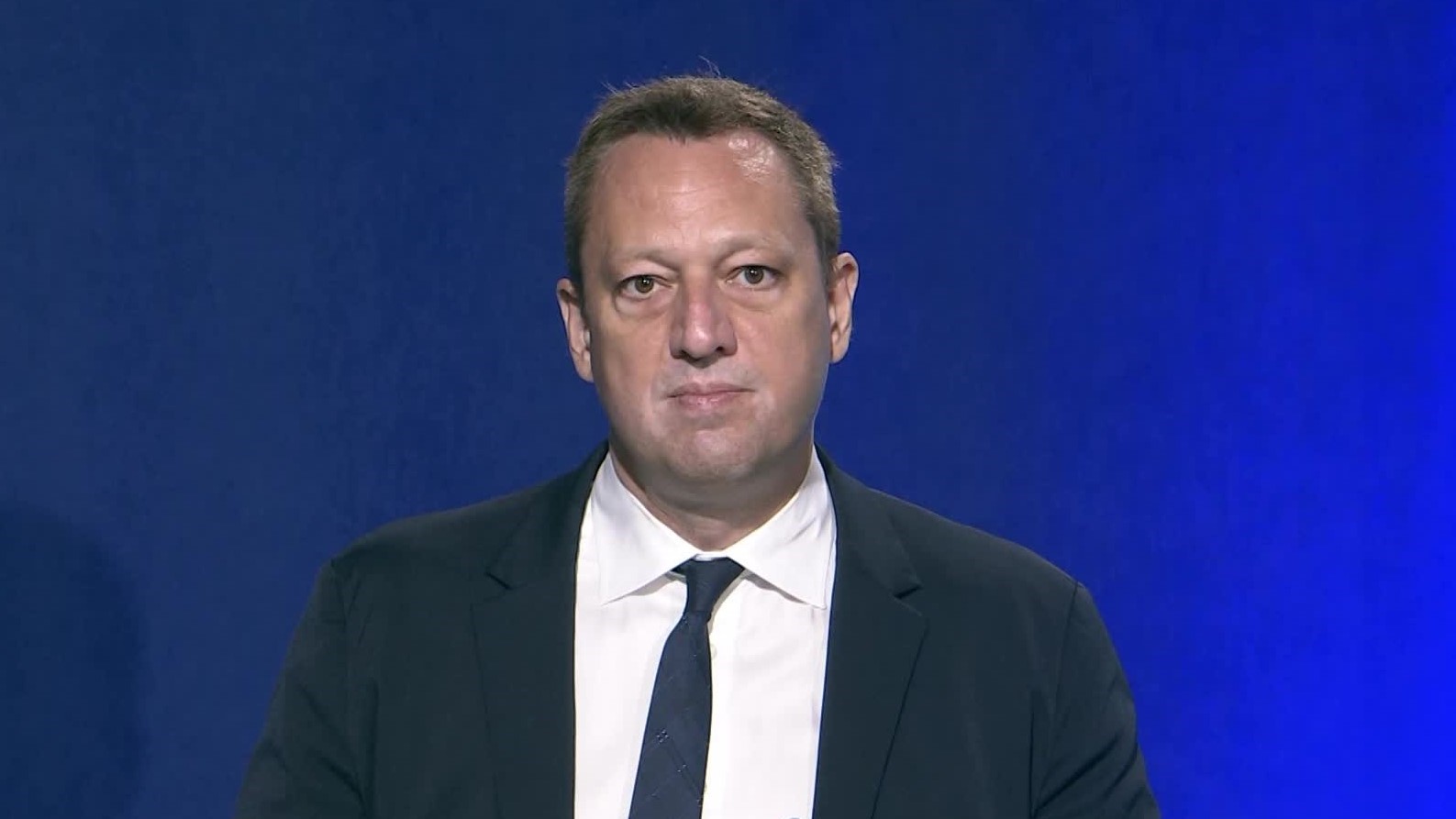

Easing monetary and financial conditions have supported markets and investors, but a rise in leverage and debt is a risk to stability, the IMF’s Financial Counselor Tobias Adrian said Thursday (June 25) in Washington, DC.

Risk asset prices have rebounded following the precipitous fall early in the year, while benchmark interest rates have declined, leading to an overall easing of financial conditions.

Swift and bold actions by central banks aimed at addressing severe market stress have boosted market sentiment, including in emerging markets, where asset purchases have been deployed in a number of countries for the first time, helping bring about the easing in financial conditions.

“We estimate that central banks balance sheets have increased by over six trillion (USD) in just three months. Such unprecedented actions could have unintended consequences, such as fueling asset valuations beyond fundamental values simply on expectations of lasting support by policy makers,” said Adrian at the launch of the Fund’s Global Financial Stability Report Update.

Amid huge uncertainties, a disconnect between financial markets and the evolution of the real economy has emerged, a vulnerability that could pose a threat to the recovery should investor risk appetite fade.

“The unprecedented rise of unconventional tools has surely cushioned the pandemic's blow to the global economy, thus reducing the immediate danger to the global financial system. However, policymakers should be attentive to possible unintended consequences, such as the continued build-up of vulnerabilities in an environment of easy financial conditions,” he said in a virtual news conference.

“The expectation of continued support from central banks could turn already stretched asset valuations into vulnerabilities. That is especially bothersome in the context of financial systems and corporate sectors that are depleting their buffers during the pandemic,” Adrian added.

Adrian said that reforms after the 2008 Great Financial Crisis have left banks globally in a much better place to weather the storm, but policy makers should carefully consider actions that reduce regulation and oversight.

“So the easing of financial conditions via monetary policy should be accompanied by a careful assessment of prudential policies, not just in the financial sector and the nonbank financial sector in particular, but also in the corporate household and sovereign sector.”

Particularly in Sub-Sahara Africa financial systems were vulnerable to the crisis, but good governance and easy financial conditions have kept access to funding available, including through the IMF said Adrian.

“We at the Fund remain deeply engaged with many countries in the region in order to help to stem the adverse consequences of this pandemic. And indeed, globally, we have just accomplished over 70 rapid financing facilities for countries around the world, many of which are in sub-Saharan Africa.”

The full report is available Click here