From 2035, new cars within the European Union will be required to be CO2-emission free. Vehicle manufacturers are focusing primarily on electromobility, which requires a wide variety of metals and rare earths, some of which are available only in limited quantities. Or in a nutshell: are there enough raw materials available to facilitate the drive turnaround?

The most important raw material for the drive turnaround shimmers in silver, white and grey: lithium, an alkali metal, whose ancient Greek name is rather mundanely translated in English as ‘stone’. But without this stone, a modern electric car wouldn’t even be able to move. This is because its excellent electrochemical properties are what make rechargeable batteries with a high energy density possible in the first place. ‘A typical electric car contains around eight or nine kilograms of lithium in various cathode material compositions,’ explains Dr Matthias Buchert. He is head of the Resources and Mobility division at the independent research institute Öko-Institut e. V. and advises many, including the directorates-general of the European Union (EU). As he explains, the lithium ion battery is at the heart of the modern electric drive concept and this is unlikely to change in the foreseeable future.

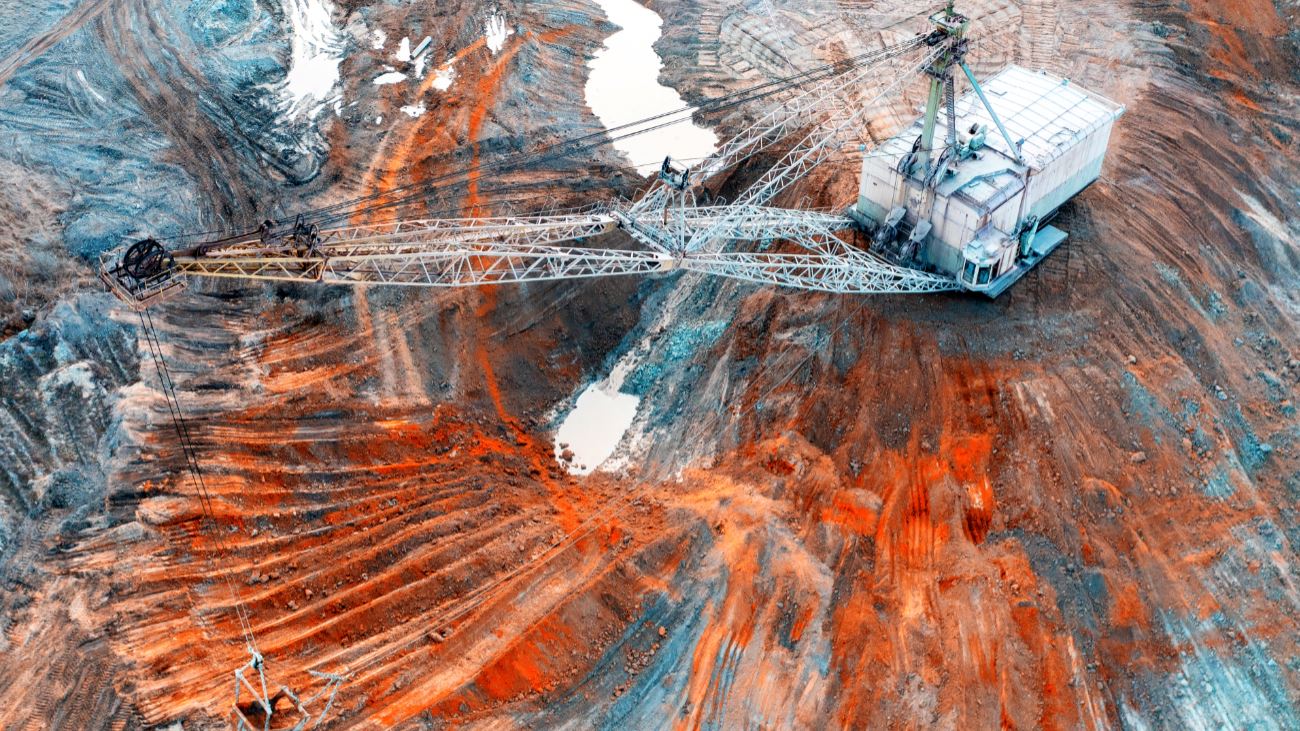

However, lithium is not the only important raw material for electromobility. Copper, for example, is also in high demand for electric cars because of its excellent electrical conductive properties. At around 70 kilograms per car, approximately three times as much is required for an electric car compared to a car with a combustion engine. Cobalt, nickel, manganese, graphite and other rare earths are also used in electric drive technologies. So the question is: where do all these raw materials come from and do we have enough of them to effect the drive turnaround?

There is only enough cobalt left for eleven years

‘As far as we are currently aware, there are no reserves in Europe that would be sufficient,’ says Dr Karl Lichtblau, Managing Director of the Institut der deutschen Wirtschaft (IW Consult), which regularly carries out studies on this topic for companies and political bodies. The largest lithium reserve we know about, comprising around nine million tonnes, is located in Chile, followed by reserves in Australia, Argentina and China. Provided the supply chain functioned well, there would be enough lithium in the world to enable a global transition in drivetrains. But it is another raw material he is worried about: cobalt.

‘With global consumption as it is at present, cobalt reserves will only last for around eleven years. Around half of the known reserves are in the Congo, where it is mined in conditions that are sometimes problematic with regard to human rights,’ says Lichtblau. The heavy metal has been important in many industrial applications for a long time, such as the hardening of metals and the manufacturing of magnets. Cars with combustion engines generally only contain a few grams of cobalt. By contrast, electric cars contain quantities in the two-figure kilogram range, as cobalt is an important component of lithium ion batteries. It ensures a particularly high energy density, high ranges, quick charging times and smaller batteries.

Researchers are working on raw material-optimised batteries

As Lichtblau states, the increasing importance of electromobility means that the demand for cobalt is also increasing. As a result, the seven million tonnes of reserves that we know about could even be exhausted in less than eleven years. He adds: ‘We are currently realising that electric drive concepts using lithium ion batteries are increasingly being tested in the lorry segment too. This is a new development as previously all focus has been on hydrogen.’

So will the shortage of cobalt become a problem for e-mobility and the drive turnaround? Öko-Institut expert Buchert gives the partial all-clear: ‘The specific cobalt content of the cathode material in lithium ion batteries that dominates the European automotive market (lithium-ion-manganese-cobalt-oxide) has already been significantly reduced,’ he says. He adds that research is being carried out into further reducing the proportion of cobalt and even on energy storage systems that do not use cobalt, such as a new generation of lithium iron phosphate batteries. ‘The energy density of these batteries is somewhat lower. However, we assume that in the small car segment, there will be lower demands with regard to the mileage capability of electric cars,’ explains Buchert.

Recycling could cover half the raw material demand

Is it just research and development that can help us counter scarcity of raw materials? ‘No, it is obvious that we need a comprehensive battery recycling programme,’ stipulates Buchert. He hopes that the EU will soon introduce a new battery directive that will be applicable in all 27 member states. ‘We know that many European countries have already made an industrial policy decision that takes into account the importance of production, research and raw material recycling when it comes to batteries. We are also currently experiencing an upswing in battery recycling plants,’ says Buchert. The Belgian metallurgy group Umicore, for example, wants to build the biggest battery recycling plant in the world in Europe by 2026, at a cost of an estimated 500 million euros. This corresponds to a capacity of 150,000 tonnes per year. By way of comparison: today's large plants can cope with just 12,000 tonnes.

But what per cent of raw materials could be covered by recycling in the best case scenario? Buchert answers: ‘The recycling effect will be somewhat delayed. In the first few years, it will be just a few per cent because the batteries will remain in vehicles for a long time and then might have a second life in stationary battery storage systems. But after 2035, the proportion of coverage could exceed one tenth and at some point, recycling will provide half of the required raw materials for e-mobility – and from domestic production alone, so from existing electric cars on our roads.’ Karl Lichtblau from the Institut der Deutschen Wirtschaft emphasises the importance of the efficient recycling of raw materials in batteries, but also adds: ‘Recycling must be incorporated from the very beginning; it starts with the design and manufacture of batteries and drive components so as to ensure that the raw materials can be extracted again as easily as possible. At the moment, this is still not a profitable endeavour for companies.

Raw material availability is also dependent on geopolitics

However, recycling and research alone will not be enough, says Lichtblau. ‘Clever geopolitics and diplomacy are key if we are to effect the drive turnaround within the set timeframe.’ What he means by this is what we recently saw happen with nickel, a silver-coloured metal, which is required for the cathodes (negative pole) of batteries, just like cobalt. Following Russia’s attack on Ukraine in contravention of international law, the price of nickel rocketed in a short space of time and the London Metal Exchange even had to suspend trading for a while. This is because Russia is one of the biggest exporters of nickel in the world. Concern about supply bottlenecks due to Western sanctions and Russian countersanctions was high. ‘We will have an even bigger problem on our hands if there is a geopolitical conflict between the West and China. If that turns out to be the case, I have my doubts whether a drive turnaround in Europe could happen in the planned timeframe,’ warns Lichtblau.

According to data from the German Raw Materials Agency (DERA), China is, after all, the EU's most important raw material supplier of metals and ores, even ahead of Russia. Rare earths such as neodymium and dysprosium are particularly important for electromobility. China dominates globally here in terms of both reserves and processing. One figure from the European Raw Materials Alliance (ERMA) makes the dependence on China particularly clear: although the EU is a globally leading manufacturer of electric engines, it imports 90 per cent of the rare earth-based permanent magnets required for these engines from China. ‘If the Chinese government were to strategically deploy its dominant position in respect of raw materials to achieve political goals, that would lead to bottlenecks in Europe,’ says Lichtblau.

Raw materials from space?

In the end, Europe's ability to influence geopolitical developments is limited. And even the most robust research efforts cannot guarantee that we can find the perfect technology for sufficiently available raw materials. It is therefore all the more important that we have an effective recycling programme for electromobility so that we can make the drive turnaround a success.

But what about the plans that we're always reading about in the media to mine rare raw materials in space, for example on asteroids? Raw material experts share the same opinion on this: ‘A few years ago we had the same discussion about mining rare earths from the depths of the sea,’ remembers Buchert. Nothing came of it because the cost and effort required were completely out of proportion with the benefits. ‘The seabed is still a more likely contender than space,’ says Lichtblau, adding: ‘Even if it were technically possible at some point, there would be no economic sense in it. It would be a lot better to efficiently use and recycle the raw materials we have on our planet.’

Continue reading in our Mobility & Logistics newsletter: